Please refer to important disclosures at the end of this report

1

Market share gainer, while maintaining best-in-class margins: CARE is the second

largest rating agency in India, with large PSU banks such as IDBI, Canara and

SBI, being its prominent shareholders (pre-offer combined shareholding of

58.2%). CARE has garnered market share from its globally affiliated peers in the

past few years and even while doing so, it has maintained its superior margins.

Overall the operating margins for CARE have been significantly higher, as unlike

its other two listed peers, its sole business segment currently is rating services,

which has enjoyed higher margins than research or any other division. Even

comparing the ratings business, CARE has witnessed impressive EBIT margins

(71% in FY2012) which are substantially higher than that of its peers (ICRA’s 48%

in FY2012, and CRISIL’s 40% in CY2011), which as per the management, is

primarily due to a) lower employee costs owing to its low-cost centralized back

office at Ahmedabad (staff costs as a percentage to revenues are almost half vs.

peers) and b) relatively lower SME/MSE ratings business (which involves lower

margins on account of its lower revenue per customer).

Rating business to primarily drive top-line growth for next few years: Rating

business will remain company’s sole business segment at least in the next few years.

Considering credit growth estimates of 15-17% over the next few years and efforts for

growing our nascent debt market, we expect CARE to register at least similar kind of

growth in its volume of debt rated. However, considering the fact that its revenue

stream has stabilized now, and intention to increase presence in SME/MSE ratings, we

expect growth in its revenue to be approx. 200-300bp lower than the growth in its

volume. Migration to IRB approach, in our view will affect the most to the rating

agency which has major part of its business coming from SME/MSE ratings (as

smaller enterprises normally take loan from a single bank as against larger ones

which usually avail loan from consortium of banks, all of whom might not be

approved for IRB). Having said that, a relatively smaller SME/MSE rating business for

CARE (entered only in FY2011) and ample time to develop other alternative revenue

streams (as impact of IRB on business will not be before FY2016), gives us adequate

comfort to believe that the impact would be manageable for the company.

Outlook and valuation: The stock is valued at 17.9x at upper band on TTM

earnings (taking 2HFY2012 earnings to be 60% of entire FY2012), which is at a

~18% discount to ICRA and ~45% discount to CRISIL. Even on a TTM EV/EBITDA

basis, it is valued at ~39% discount to CRISIL and ~33% to ICRA. However, on a

TTM EV/Sales basis, it is valued at ~27% premium to CRISIL and ~63% premium to

ICRA, which is due to its high margins (likely to have a downward bias from here

on). The company has reported cash and current investments worth `91/share as of

1HFY2013. Overall, considering the high intellectual capital/knowledge oriented

and cash generating nature of the business, combined with reasonable 12-15%

revenue growth expectation, we believe the IPO is reasonably priced at the upper

band. Hence, we recommend subscribe to the issue.

Key financials

Y/E March (` cr) FY2009 FY2010 FY2011

FY2012

1HFY13

Net Sales 94 136 166

189

90

% chg 81.4 44.6 22.2

13.5

-

Net Profit 52 86 88

116

50

% chg 97.5 63.5 2.6

31.6

-

Basic EPS 18.4 30.0 30.8

40.5

17.5

P/E (x) Lower End 38.1 23.3 22.7

17.3

16.0

P/E (x) Upper End 40.9 25.0 24.3

18.5

17.1

EBIT Margins 76.5 78.1 74.2

70.6

64.1

RoE (%) 48.4 49.4 34.6

34.5

34.1

Source: Company, Angel Research, Note: P/E, P/BV and ROE, for 1HFY13 calculated on an

annualized basis, assuming 1H:2H mix of 40:60.

SUBSCRIBE

Issue Open: December 7, 2012

Issue Close: December 11, 2012

Issue Details

Face Value: `10

Present Eq. Paid-up Capital: `28.6cr

Offer Size: 0.72cr Shares (offer for sale)

Post Eq. Paid-up Capital: `28.6cr

Issue size (amount):* `504-540cr

Price Band: `700-750

Post-issue implied mkt. cap*: `1,999cr-

2,141cr

Promoters holding Pre-Issue: 0.0%

Promoters holding Post-Issue: 0.0%

Note:*

A

t the lower and u

p

per price band,

respectively

Book Building

QIBs Up to 50%

Non-Institutional At least 15%

Retail At least 35%

Post Issue Shareholding Pattern

Promoters Group 0.0

MF/Banks/Indian

FIs/FIIs/Public & Others

100.0

Vaibhav Agrawal

022 – 39357800 Ext: 6808

Sourabh Taparia

022 – 39357800 Ext: 6872

Credit Analysis and Research (CARE)

Quality at a reasonable price

IPO Note

|

Rating Agencies

December 6, 2012

CARE

|

IPO Note

December 6, 2012

2

Company background

Credit Analysis and Research Ltd (CARE) is the second largest rating company in

India (on rating turnover basis). It was the third company to enter the credit rating

industry in India (with there being a total of six players as of now), when it

commenced operations in 1993. It is the leading credit rating agency in India for

IPO grading, having graded the largest number of IPOs since the introduction of

IPO grading.

It provides a wide range of rating and grading services across a diverse range of

instruments and industries. The company has been rating debt instruments and

related obligations covering a wide range of sectors for the last 19 years. Since

incorporation, it has completed 19,058 rating assignments and rated `44,036bn

of debt as of September 30, 2012. It had rating relationships with 4,644 clients as

of September 30, 2012.

It has, in the last few years, diversified its income generating pool of products by

entering into IPO grading, equity grading, and grading of various types of

enterprises, including ESCO, RESCO, shipyards, maritime training institutes,

construction companies and rating of real estate projects. It also provides general

and customized industry research reports. Its research team actively covers

39 sectors as of September 30, 2012 and releases periodical industry research

reports on these sectors.

The company has expanded its footprint outside India in its rating business, apart

from providing technical know-how to a credit rating agency each in Mexico and

Ecuador for a fee. It has been granted recognition for various levels of rating

activities in Maldives, Mauritius and Hong Kong. In Maldives, the company can

carry out ratings of debt instruments/bank facilities in respect of Maldivian

companies (it has already set up operation there and completed two rating

assignments), while in Mauritius its ratings are recognizable for risk weighting for

banks’ capital adequacy purposes. In Hong Kong, the company has received

approval to act as an external credit assessment institution for the purposes of the

regulatory capital framework.

Its existing shareholders include domestic banks and financial institutions, such as

IDBI Bank, Canara Bank, SBI, IL&FS and Federal Bank (cumulatively they hold

73.4% shareholding, which will reduce to 49.1% post the successful completion of

offer for sale).

Details of the issue

The IPO comprises an issue of 7.2mn equity shares of face value `10 each to the

public. The issue shall constitute 25.2% of the post-issue paid-up capital. The price

band for the issue has been fixed at `700–750 per share, valuing the company at

`2,000cr to `2,141cr. The key shareholders who are tendering their shares are

IDBI Bank (2.5mn shares), Canara Bank (2.2mn shares), SBI (0.9mn shares), IL&FS

(0.9mn shares) and Federal Bank (0.5mn shares). The remaining 0.3mn shares

are being offered by Tata Investments, ING Vysya, Milestone Fund and others.

CARE will not get any money from this IPO as it is an offer for sale.

CARE

|

IPO Note

December 6, 2012

3

Investment arguments

Gained market share, while maintaining best-in-class margins

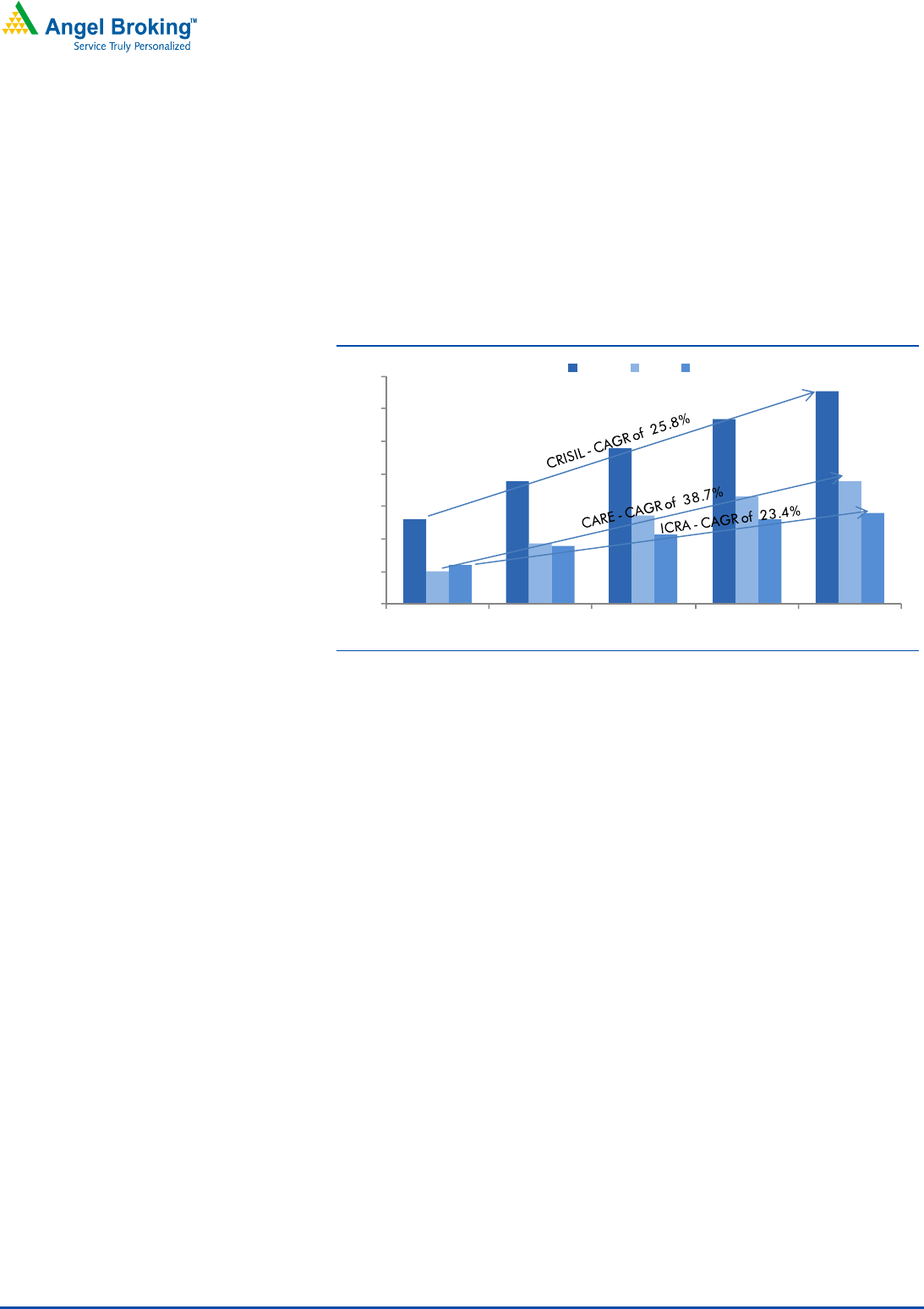

CARE has been able to garner market share from its globally affiliated peers in the

past few years, as it has outpaced them by achieving a rating turnover CAGR of

38.7% over FY2008-12 as against a CAGR of 23.3% for ICRA and 25.8% for

CRISIL during the same period. Even while it increased its market share, the

company has been able to maintain its superior margins.

Exhibit 1: Grew fastest among top three rating agencies

Source: Company, Angel Research, Note: *December year end

Its overall operating margins are significantly higher, as unlike the other two listed

peers, its sole business segment currently is rating services, which for any rating

company has enjoyed higher margins than research or any other division (99.4%

of its FY2012 revenues came from the rating business, as against 67.2% for ICRA

during the same period and 40.4% for CRISIL during CY2011).

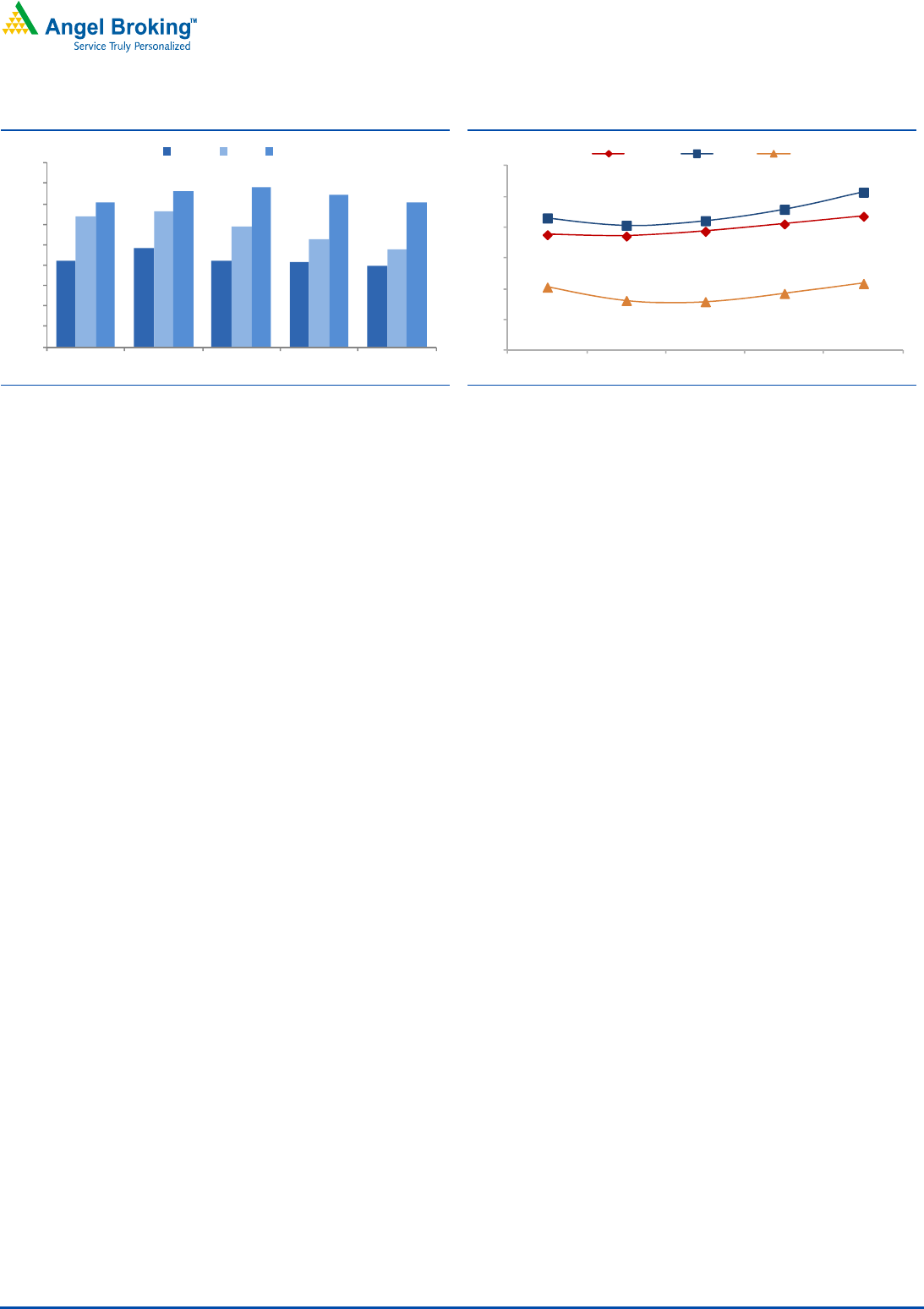

Even in its rating business, CARE posted impressive EBIT margins of 71% in

FY2012, which is substantially higher than its peers (ICRA’s rating division margins

were at 48% in FY2012, whereas for CRISIL they were at 40% in CY2011). Key

factors contributing to the impressive margins performance, as per the

management are a) lower employee costs owing to its low-cost centralized back

office at Ahmedabad (staff cost as % to revenues significantly lower for CARE at

22% in FY2012, compared to 44% for CRISIL in CY2011 and 51% for ICRA in

FY2012) and b) relatively lower SME and MSME ratings business which involves

lower margins on account of its lower ticket size and lower revenue per customer

(as per management, expansion into SME/MSME ratings was the primary reason

for decline in EBIT margins for CARE from levels of 78% in FY2010 to 71% in

FY2012).

‐

50

100

150

200

250

300

350

FY2008 FY2009 FY2010 FY2011 FY2012

CRISIL* CARE ICRA

CARE

|

IPO Note

December 6, 2012

4

Exhibit 2: Margins

#

for Rating business

Source: Company, Angel Research, Note:*calendar year for CRISIL,

#

PBI

T

margins considering consolidated segmental breakup for CRISIL and ICRA

,

whereas EBIT margins for CARE

Exhibit 3: Staff Costs

#

as % of Revenues

#

Source: Company, Angel Research

,

Note:*calendar year for CRISIL,

#

consolidated numbers have been considered for CRISIL and ICRA

Going ahead, owing to the expected increase in SME/MSME rating business, focus

on developing its research business and limited scope for further operational

efficiency, operating margins for CARE are unlikely to sustain at these levels and

evidently so they have declined to 64% in 1HFY2013 (however they can be

expected to remain much higher for the company compared to its peers).

42

48

42

42

40

64

66

59

53

48

71

76

78

74

71

‐

10

20

30

40

50

60

70

80

90

FY2008 FY200 9 FY20 10 FY2 011 FY2012

CRISIL* ICRA CARE

38

37

39

41

44

43

41

42

46

51

21

16

16

18

22

-

10

20

30

40

50

60

FY2008 FY2009 FY2010 FY2011 FY2012

(%)

CRISIL* ICRA CARE

CARE

|

IPO Note

December 6, 2012

5

Growth strategy going ahead

Rating business to primarily drive top-line growth for next few

years

CARE’s sole business segment currently is rating services (99% of its revenues in

FY2012 came from the rating business). Its rating revenues are directly linked to

the volume of debt instruments issued and bank loans/facilities provided (as rating

income is typically a percentage of the volume rated), which in turn is dependent

on clients’ current debt position, credit worthiness, prevailing interest rates,

investment sentiments and alternative funding options, most of which are directly

correlated to the economic growth and credit growth.

Going forward, considering an estimated credit growth range of 15-17% over the

next few years and persistent efforts of the Indian government to grow our nascent

debt market, we expect CARE to register at least a similar kind of growth in its

rating volume of debt instrument issued and bank loan/facilities provided (could

be higher if it captures market share as the company has plans to increase its

business development managers by ~30%).

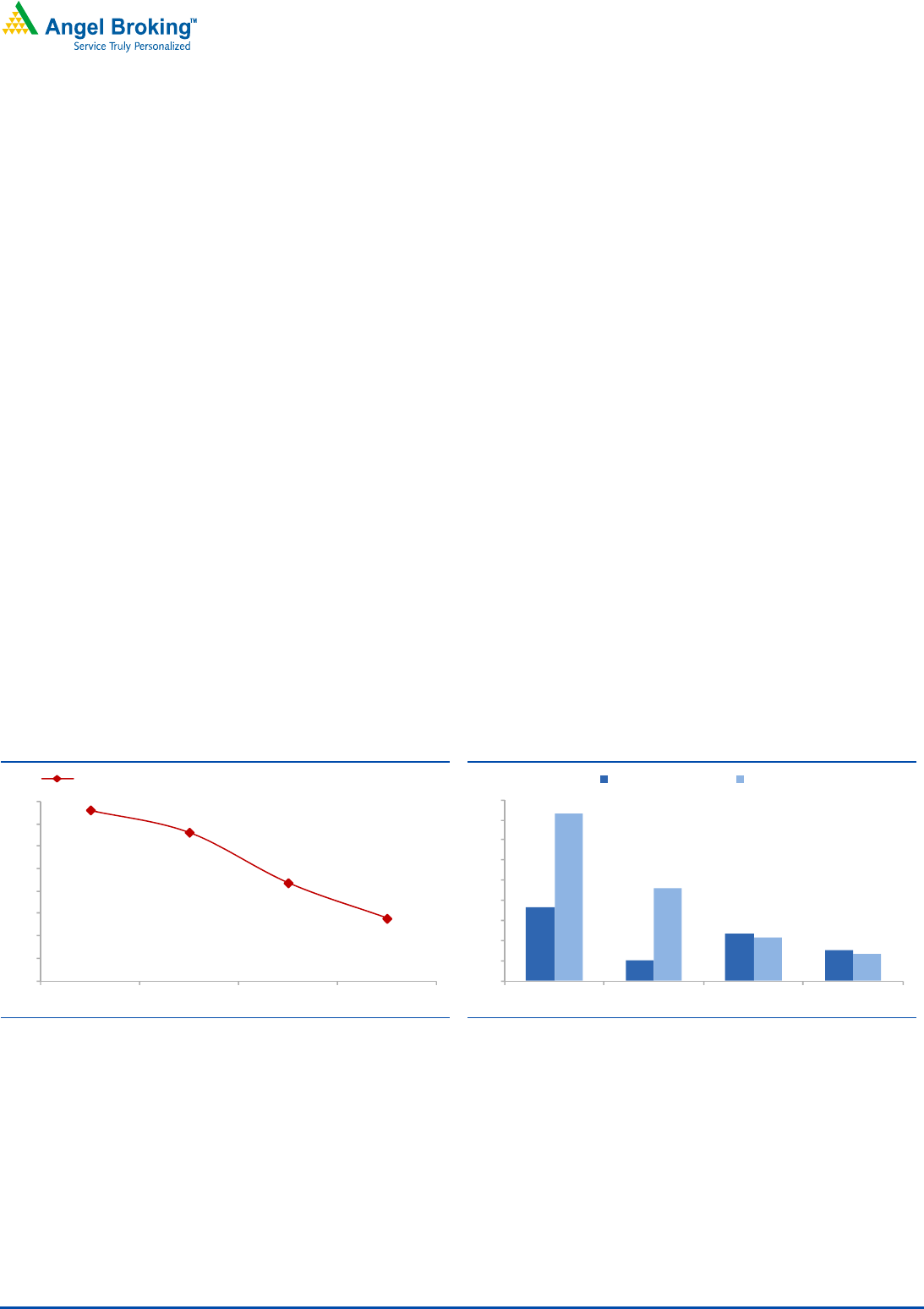

However, considering the fact that its revenue stream has stabilized now, (evident

from reducing share of the initial fee income on bank loan/facility rated as

percentage of total rating income from 30% in FY2010 to 20% as of 1HFY2013)

and its intention to increase presence in SME/MSE ratings, we expect growth in its

revenue to be ~200bp lower than the growth in its volume (as surveillance

fee/annuitized fee component of its revenue gains prominence and SME/MSE

rating business being lower revenue and higher volume based business).

Exhibit 4: Reducing share of initial rating fee, shows...

Source: Company, Angel Research

Exhibit 5: ...revenue growth is stabilizing for CARE

Source: Company, Angel Research

Meaningful contribution from research division only after few

years

CARE’s research team, which actively covers 39 sectors, currently acts as in-house

support to its ratings team. Though the research offerings of the company are

available on subscription basis, the revenue from the research division has been

negligible till now, owing to lower sector coverage compared to peers, that are

particularly associated with international rating agencies, and lesser market

awareness of its research capabilities. Going forward, the company intends to

focus on expanding its industry research coverage (which is a time consuming

30

28

24

21

15

17

19

21

23

25

27

29

31

FY2010 FY2011 FY2012 1HFY2013

(%)

share of initial rating fee on bank loans as % to total rating income

37

10

24

15

83

46

22

14

0

10

20

30

40

50

60

70

80

90

FY2009 FY2010 FY2011 FY2012

(%)

Debt volume growth Revenue growth

CARE

|

IPO Note

December 6, 2012

6

exercise and core part of business) and then it would strive to increase the number

of subscribers to its research offerings, by leveraging its network of business

development managers (150 as of FY2012) and actively targeting financial

intermediaries, corporates, and policy makers and marketing its research products

to them. Hence, we believe it will take at least the next few years for any

meaningful contribution from the research division to come in.

Entry into new business segments to increase product offering

Recently, CARE has acquired a 75.1% stake in Kalypto, a company providing risk

management software solutions primarily for BFSI companies. Through this

acquisition, the company has acquired a ready product offering in the risk

management domain (where it had no presence earlier) and in our view, it can

build up an alternate revenue stream which is a time consuming exercise.

Moreover, capitalizing on its strong brand recognition, the company has ambitions

to expand into new business segments, such as providing training, knowledge

process outsourcing, risk management and other support services to rating

agencies and other financial institutions and also providing advisory services in or

outside India.

Overseas expansion to add value only after few years

CARE has expanded its footprint outside India in its rating business, apart from

providing technical know-how to a credit rating agency each in Mexico and

Ecuador for a fee. It has been granted recognition for various levels of rating

activities in Maldives, Mauritius and Hong Kong. Also, the company intends to

expand its rating business to other countries including Nepal and Mauritius, by

form of joint venture/partnership or acquisition. It also has ambitions to set up an

international credit rating agency, for which it has signed a non-binding

memorandum of understanding with four credit rating agencies, each located in

Brazil, Portugal, Malaysia and South Africa.

In our view, international aspirations for the company are likely to bear fruit only

after next few years, as it has recently set up operations/is yet to set up operations

in the above mentioned countries.

CARE

|

IPO Note

December 6, 2012

7

Key risks/concerns

Switch to the IRB approach

Pursuant to use of ratings given by credit rating agencies for measuring credit risk

for capital adequacy purposes, rating of bank facilities/loans has become a core

part of CARE’s operations or for that matter any other rating company operating in

India currently (share of only initial rating fee income on bank loan/facility rated as

a percentage to its total rating income for CARE was ~21% in 1HFY2013). RBI has

allowed banks to apply for migrating to IRB approach and beginning April 2014, it

might begin approving them to use its own internal rating for measuring credit risk

for capital adequacy purposes, which will run parallel to ratings of external rating

agencies for the next eighteen months.

In the event, banks which are large and thus capable enough, get themselves

approved for using its internal rating (most of the large private banks and a few

large PSU banks have evinced readiness of setup), which in our view, will affect

those rating agencies the most which have a major part of their business coming

from SME/MSE ratings. Smaller enterprises normally take loan/facilities from a

single bank as against larger ones which usually avail loan/facilities from a

consortium of banks, all of whom might not be approved for IRB.

Having said that, a relatively smaller SME/MSE rating business for CARE (as it had

started this segment only in FY2011) and ample time for developing other

alternative revenue streams (as impact on business due to IRB will not be before

FY2016), gives us adequate comfort to believe that the impact would be

manageable for the company.

Concentration risk

CARE’s sole business segment currently is providing rating services (largely debt),

which in a way has aided the company to generate superior margins; on the other

hand it has led to concentration risk for the company. Though the company has

taken several steps to de-risk itself and diversify its business by expanding its

income generating pool of products (SME/MSE ratings, Edu-grade, Equi-grade,

Real Estate star ratings and many others), developing its business in markets

outside India (Maldives, Mauritius and Hong Kong so far) and growing its research

business, we believe at least in the medium term the company will continue to

depend primarily on the business of providing ratings services.

Margins unlikely to sustain at current levels

CARE has enjoyed significantly higher operating margins as compared to its peers,

as its sole business segment has been rating services (compared to others, for

whom research and other divisions have been significant contributors to revenues).

Margins have been on a declining trend since FY2011, when the company started

SME/MSME rating business and going forward they are unlikely to sustain at the

current levels, as the company looks to further grow its SME/MSME rating business

and increase focus on developing its research business (though they will remain

significantly higher than its peers due to its employee cost advantage and the fact

that it had maintained margins during the last four years, when it gained market

share, gives us additional comfort, in that respect). Hence, though we expect

revenue growth for CARE to be reasonably healthy at 12-15%, considering

CARE

|

IPO Note

December 6, 2012

8

expectation of declining trend in margins, earnings growth would have a

downward bias.

Outlook and valuation

The stock is valued at 17.9x at upper band on trailing twelve month earnings

(taking 2HFY2012 earnings to be 60% of entire FY2012), which is at a ~18%

discount to ICRA and ~45% discount to CRISIL. Even on a TTM EV/EBITDA basis, it

is valued at ~39% discount to CRISIL and ~33% to ICRA. However, on a TTM

EV/Sales basis, it is valued at ~27% premium to CRISIL and ~63% premium to

ICRA, which is due to its high margins (likely to have a downward bias from here

on). The company has reported cash and current investments worth `260cr at the

end of 1HFY2013, which works out to `91/share. Overall, considering the high

intellectual capital/knowledge oriented and cash generating nature of the

business, combined with reasonable 12-15% revenue growth expectation, we

believe the IPO is reasonably priced at the upper band. Hence, we recommend

subscribe to the issue.

Exhibit 6: Recommendation Summary on TTM (trailing twelve month) basis

Company

M Cap*

(` cr)

Sales

(` cr)

EBITD

A

(` cr)

Profit

(` cr)

RoEs

(%)

EV/EBITD

A

(x)

EV/Sales

(x)

EBITDA Margin

(%)

P/E

(x)

CRISIL 7,087 942 313 216 48.3 21.9 7.3 33.2 32.8

ICRA 1,384 230 65 64 21.1 20.0 5.7 28.4 21.7

CARE 2,141 203 140 119 32.5 13.4 9.3 69.0 17.9

Source: Company, Angel Research, Note: *at CMP of December 6,2012 for CRISIL and ICRA, and at upper end of its price band for CARE

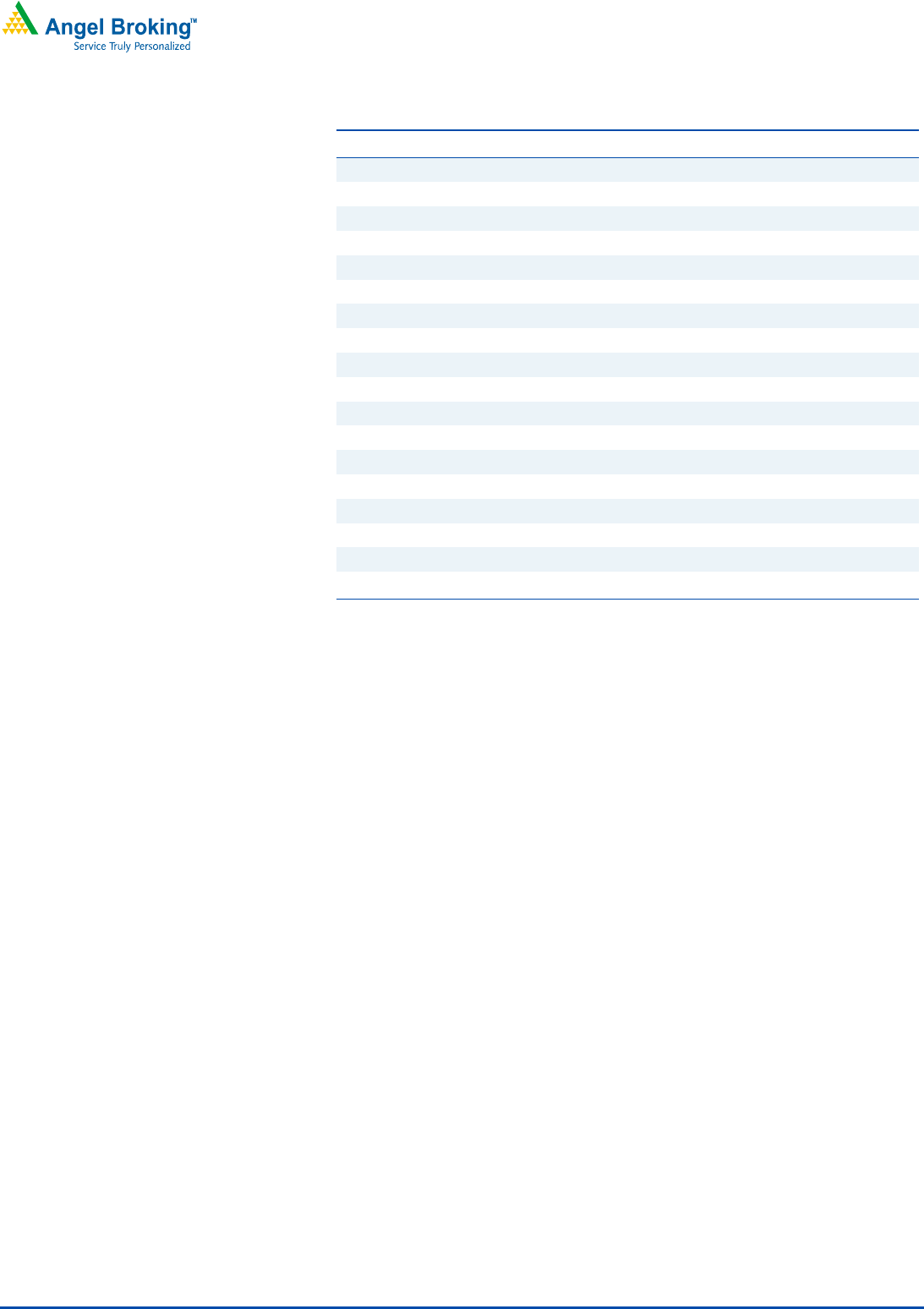

Exhibit 7: Sector P/E band on TTM basis

Source: BSE, Company, Angel Research

0

2,000

4,000

6,000

8,000

10,000

12,000

Apr-02

Sep-02

Feb-03

Jul-03

Dec-03

May-04

Oct-04

Mar-05

Aug-05

Jan-06

Jun-06

Nov-06

Apr-07

Sep-07

Feb-08

Jul-08

Dec-08

May-09

Oct-09

Mar-10

Aug-10

Jan-11

Jun-11

Nov-11

Apr-12

Sep-12

M cap (` cr)

13x 19x 25x 31x 37x

CARE

|

IPO Note

December 6, 2012

9

Income Statement

Y/E March. (` cr) FY2009

FY2010

FY2011

FY2012

1HFY13E

Total operating income 94

136

166

189

90

% chg 81.4

44.6

2

2.2

13.5

-

Total Expenditure 21

28

41

54

31

Other Expenses 6

7

10

13

7

Personnel Expenses 15

22

31

41

24

EBITDA 73

108

126

135

59

% chg 95.1

47.7

16.7

7.5

-

(% of Net Sales) 77.5

79.2

75.6

71.6

65.8

Depreciation & amortization 1

1

2

2

2

EBIT 72

106

124

133

58

% chg 95.6

47.8

16.1

7.9

-

(% of Net Sales) 76.5

78.1

74.2

70.6

64.1

Interest & other Charges - - - - -

Other Income 6

16

6

28

13

(% of PBT) 7.4

12.9

4.5

17.5

18.0

Recurring PBT 78

122

129

162

70

(% of Net Sales) 82.6

89.8

77.7

85.5

78.1

Tax 25

37

41

46

20

(% of PBT) 32.6

2

9.9

32.0

2

8.4

2

8.8

Reported PAT 52

86

88

116

50

% chg 97.5

63.5

2

.6

31.6

-

(% of Net Sales) 55.6

62.9

52.8

61.2

55.7

Basic EPS (`) 18.4

30.0

30.8

40.5

17.5

% chg 97.5

63.5

2

.6

31.6

-

CARE

|

IPO Note

December 6, 2012

10

Balance Sheet

Y/E March (` cr) FY2009

FY2010

FY2011

FY2012 1HFY13E

SOURCES OF FUNDS

Equity Share Capital 8

10

10

29 29

Share Application Money 1

- - - -

Reserves& Surplus 125

204

285

348 398

Shareholders’ Funds 133

213

294

377 427

Total Loans - - - - -

Deferred Tax Liability 2

2

3

4 4

Other long term liabilities - - - - -

Long term provisions 1

1

2

2 4

Total Liabilities 137

217

299

383 435

APPLICATION OF FUNDS

Net Block 18

28

42

48 48

Investments 16

117

53

104 114

Long term loans and advances 5

8

7

11 13

Other non-current assets 5

6

5

1 1

Current Assets 114

86

228

263 319

Cash 6

9

9

69 27

Loans & Advances 0

1

0

1 1

Current Investments 102

69

206

170 232

Debtors 5

7

12

16 52

Other 1

0

1

7 5

Current liabilities & provisions 21

28

37

46 59

Net Current Assets 93

59

191

217 260

Total Assets 137

217

299

383 435

CARE

|

IPO Note

December 6, 2012

11

Cash Flow Statement

Y/E March (` cr) FY2009

FY2010

FY2011

FY2012 1HFY13E

Profit before tax 78

122

129

162 70

Depreciation 1

1

2

2 2

Change in Working Capital 2

3

1

9 (23)

Less: Other income 5

16

6

28 13

Direct taxes paid 25

37

41

46 20

Cash Flow from Operations 50 75 85 98 16

(Inc.)/ Dec in Fixed Assets (9) (14) (14) (8) (1)

(Inc.)/ Dec in Investments (44) (69) (73) (11) (72)

(Inc.)/ Dec in loans and advances - - - - -

Other income 5

16

6

22 15

Cash Flow from Investing (47) (67) (81) 3 (57)

Issue/(Buy Back) of Equity 1

(0) - - -

(Inc.)/ Dec in loans - - - - -

Dividend Paid (Incl. Tax) (3) (4) (6) (40) -

Cash Flow from Financing (2) (4) (6) (40) -

Inc./(Dec.) in Cash 1

4

(1) 60 (41)

Opening Cash balances 5

6

9

9 69

Closing Cash balances 6

9

9

69 27

CARE

|

IPO Note

December 6, 2012

12

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

CARE

|

IPO Note

December 6, 2012

13

6

th

Floor, Ackruti Sta

r

, Central Road, MIDC, Andheri (E), Mumbai-

400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra VP-Research, Pharmaceutical [email protected]

V

aibhav Agrawal VP-Research, Banking [email protected]

Bhavesh Chauhan Sr. Analyst (Metals & Mining) [email protected]

V

iral Shah Sr. Analyst (Infrastructure) [email protected]

V

Srinivasan Analyst (Cement, Power, FMCG) [email protected]

Yaresh Kothari Analyst (Automobile) [email protected]

A

nkita Somani Analyst (IT, Telecom) [email protected]

Sourabh Taparia Analyst (Banking) [email protected]

V

A

Shareen Batatawala Research Associate shareen.batatawala@angelbroking.com

Tejashwini Kumari Research Associate [email protected]

Technicals:

Shardul Kulkarni Sr. Technical Analyst [email protected]

Sameet Chavan Technical Analyst [email protected]

Sacchitanand Uttekar Technical Analyst [email protected]

Derivatives:

Institutional Sales Team:

Mayuresh Joshi VP - Institutional Sales [email protected]

Hiten Sampat Sr. A.V.P- Institution sales [email protected]

A

kshay Shah Sr. Executive akshayr.shah@angelbroking.com

Production Team:

Dilip Patel Production dilipm.patel@angelbroking.com

A

ngel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

A

ngel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP /